Get This Report on Personal Insolvency

Table of ContentsAn Unbiased View of Bankruptcy VictoriaBankruptcy Melbourne - TruthsSome Known Details About Bankruptcy Our Bankruptcy Australia IdeasThe 2-Minute Rule for Bankrupt Melbourne

You'll then have time to collaborate with the court and your creditors to determine the next actions. Will I Shed My Residential property? What happens to your residential or commercial property depends upon whether you file phase 7 or phase 13 personal bankruptcy. If you're unsure which alternative is ideal for your situation, see "Insolvency: Phase 7 vs.Chapter 7Chapter 7 insolvency is commonly called liquidation bankruptcy because you will likely require to liquidate a few of your properties to please a minimum of a section of what you owe. That said, state laws figure out that some properties, such as your retired life accounts, house as well as automobile, are excluded from liquidation.

Bankruptcy Advice Melbourne Can Be Fun For Everyone

Chapter 13With a chapter 13 bankruptcy, you don't require to bother with needing to liquidate any one of your building to satisfy your debts. Instead, your financial obligations will be reorganized to make sure that you can pay them off partially or completely over the following three to five years. Bear in mind, however, that if you do not adhere to the layaway plan, your creditors may have the ability to go after your possessions to satisfy your debts.

That claimed, the two types of insolvency aren't dealt with the same method. While phase 13 personal bankruptcy is also not ideal from a credit scores point ofview, its arrangement is seen more favorably because you are still paying off at least some of your debt, as well as it will certainly remain on your credit rating record for up to seven years. Personal Insolvency.

There are some lending institutions, nonetheless, who particularly collaborate with people that have actually gone via insolvency or other tough debt occasions, so your alternatives aren't entirely gone. The credit rating scoring designs favor brand-new info over old info. With favorable credit history behaviors post-bankruptcy, your credit scores rating can recover over time, also while the bankruptcy is still on your credit rating record.

The Facts About Bankruptcy Australia Uncovered

Insolvency process are submitted in a system called Public Accessibility to Court Electronic Records, or PACER for short. Essentially, it's even more usual for lawyers and creditors to utilize this system to seek out info concerning your insolvency. Any individual can register as well as inspect if they want to.

This service is totally cost-free and can improve your credit rating fast by utilizing your very own positive settlement history. It can also help those with inadequate or limited credit report scenarios. Other solutions such as debt repair may cost you up to thousands and just aid remove inaccuracies from your credit score report.

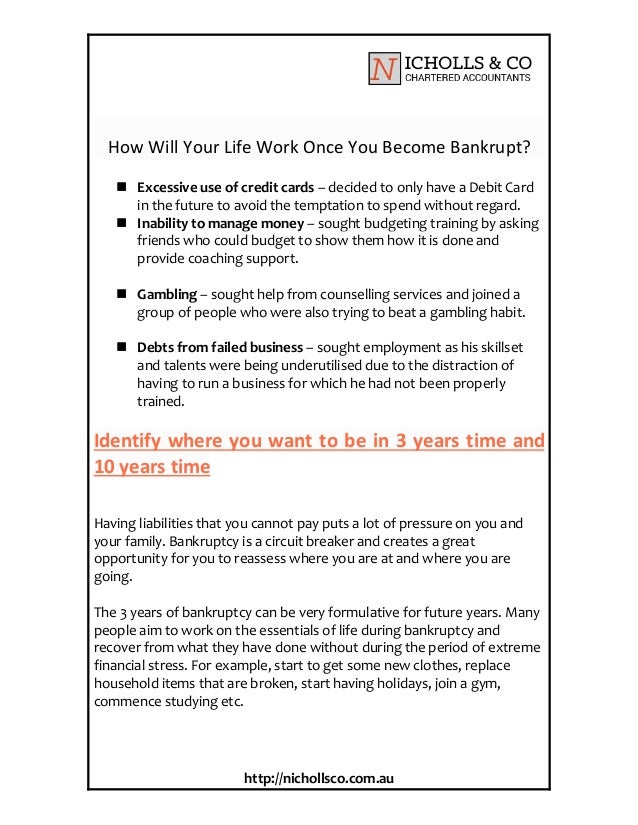

Bankruptcy is a legal procedure where somebody who can't pay their financial debts can obtain remedy for a commitment to pay some or every one of their debts. You ought to obtain assist from a financial therapy solution as well as legal advice prior to requesting personal bankruptcy. Becoming insolvent has severe consequences and there might be various other options offered to you.

The Ultimate Guide To Insolvency Melbourne

AFSA knows regarding your responsibilities while insolvent. There are serious repercussions to coming to be insolvent, including: your bankruptcy being permanently videotaped on the your personal bankruptcy being detailed on your credit score report for 5 years any kind of possessions, which are not protected, possibly being sold not having the ability to take a trip overseas without the created approval of the personal bankruptcy trustee not having the ability to hold the setting of a supervisor of a company not having the ability to hold specific public placements being limited or prevented from continuing in some trades or careers your capability to borrow money or get points on credit rating being affected your ability to obtain rental lodging your ability to get some insurance policy contracts your capacity to access some solutions Bankrupt Melbourne such as energies and also telecommunication solutions.

You're allowed to keep some assets when you end up being bankrupt. These include: many home products devices made use of to earn a revenue as much as an indexed amount automobiles where the total equity of the vehicle is much less than an indexed quantity most regulated superannuation balances and also the majority of settlements obtained from superannuation funds after you declare bankruptcy (superannuation you withdraw from your superannuation account prior to you go bankrupt are not shielded) life insurance policy plans for you or your spouse and any kind of profits from these plans obtained after your personal bankruptcy payment for an injury (eg injury from a car accident) and any assets bought with this settlement properties held by you in depend on for another person (eg a youngster's financial institution account) awards or trophies which have sentimental worth (if creditors concur).

It is very crucial to get lawful recommendations before submitting for insolvency if you own a residence. Financial obligations you must pay no matter of insolvency You will still have to pay some financial obligations even though you have ended up being bankrupt.

Getting My File For Bankruptcy To Work

These include: court imposed penalties and fines upkeep debts (consisting of youngster support financial obligations) pupil aid or supplement lendings (aid Higher Education And Learning Financing Program, HECS Higher Education And Learning Payment System, SFSS Student Financial Supplement System) financial debts you sustain after you end up being insolvent unliquidated financial debts (eg automobile mishaps) where the quantity payable for the damage hasn't been fixed before the date of bankruptcythere are some exceptions financial debts incurred by fraudulence debts you're responsible to pay due to wrongdoing (eg payment for injury) where the amount to be paid has actually not yet been fixed (unliquidated damages)there are some exceptions to this.

It doesn't matter if you're bankrupt at the beginning or end up being insolvent throughout the situation. You must inform the court, as well as everybody entailed in your situation if you're bankrupt or in a personal insolvency agreement.